-

House plans to move budget-related bills forward this week

OLYMPIA – The House is moving forward Wednesday with a short list of bills that will be necessary to implement (NTIB) the supplemental operating budget. Although an agreement on the final budget has not yet been reached, the House Democratic negotiating team wants to get the ball rolling. “We have been negotiating in good faith…

-

SB 5539 – Film Credit bill

Update 3/9/12: The bill was “pulled” from Ways and Means last night and passed the House 92-6. The official term is that Ways and Means was “relieved of consideration” of the bill. I believe this particular subsidy is similar to the way the economics of the NBA works and voted no, but clearly a majority…

-

More on the Slow Motion Default in Wenatchee

In December we passed a bill out of Ways and Means, and then the House, but not the Senate that would have allowed Wenatchee to solve its own problems about financing their money-hemorrhaging arena, the Town Toyota Center. The region has continued to work on a mutually agreeable solution and a Senate bill embodying the…

-

Good Revenue and Caseload Forecasts Reduce Severity of Budget Problem

Actually, we “found” about $87 million in the revenue forecast update and about $330 million in projections of less usage of state services over the remainder of the biennium. In addition to this there has been less utilization of services in the “TANF box,” which is what we call the bundle of services we administer…

-

Educational Goals: penny-wise and pound-foolish decisions

The Ways and Means committee heard a number of contentious bills Saturday, including HB 2538, which is intended to save money for school districts by reducing requirements that the legislature has placed on them without funding. It was requested by the governor, and most of the savings came from lowering the frequency of audits when…

-

Landmark Supreme Court Case

The week before session the Washington Supreme Court decided the McCleary case unanimously in favor of the plaintiffs – two families and a number of school districts who claimed that the state had historically underfunded its primary duty to fund education. As those of you who have followed my writings over the years know, I…

-

Data on State Employee Compensation

I’ve answered a lot of mail in the past few weeks and one theme that threads through many of the emails is that the number of state employees is increasing rapidly, that they are paid way too much, and that their benefits are vastly greater than private sector workers. The conclusion is that we should…

-

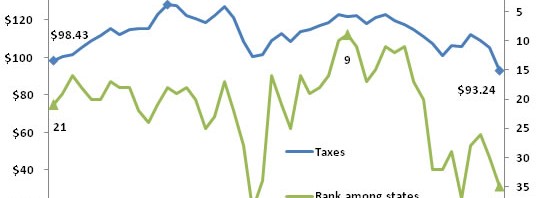

Washington State and local taxes drop to lowest level in 50 years

The DOR released this as part of their “Revenue Update” for the month. Washington’s state and local taxes (as a percent of personal income) dropped to their lowest level in 50 years in Fiscal Year 2009, according to new figures released by the U.S. Census Bureau. Washington taxes dropped to $93.24 per $1,000 personal income…

-

Internet Sales Growth Explosive, Compared to In-Store Sales

The following article was sent to me by the Streamlined Sales and Use Tax Governing Board, an organization representing more than half the states that charge sales tax. In it you see the shift to Internet retailing and the consequent loss of sales tax revenue for the state. We are attempting to convince Congress that…